How to trade futures on Binance

Binance Futures is the market leader in cryptocurrency futures trading. It allows traders to use leverage and open long and short positions

Futures Trade :

Futures trading is a common choice for traders who want to trade the future price movement of a financial asset (such as stocks, commodities or even crypto-assets). However, it is also quite risky as it requires the use of margin.

Futures traders decide on the price they want to buy an asset in the future when they enter into a futures contract. As a result, with futures, the price and the date you buy the asset are predetermined. Users will find it very easy to switch when needed, as Binance Futures has made sure that trading is as comparable as possible to their spot exchange. This and other factors have contributed to its success in becoming the best futures trading platform.

However, there is also the opposite. Margin usage is required for futures. Additionally, if you use margin, you may be able to generate even greater profits from your initial investment. In addition, you risk losing the same huge amount of money. For this reason, it is often recommended that only those with a good understanding of the market should be allowed to trade futures.

How do you trade futures on Binance

In order to trade on Binance Futures, you must register for a Binance account. Although the process is straightforward, you will need to go through identity verification due to Binance's KYC regulations. You can find information on how to sign up and save in our earlier Binance account tutorial article.

After depositing them, you will need to transfer the funds to your futures trading wallet. You can find your wallet in the upper right part of the navigation menu. Select your futures account from the drop-down menu by placing your cursor over it. Once there, you'll notice the following:

Denominated in USD (USD-S)

Futures contracts on this site are settled in stablecoins, as the name suggests. This means that you will suffer losses or gain profits in stablecoins.

Crypto denominated (coin-M)

Here, cryptocurrency is used to settle futures contracts. This means that you will track your losses or gain profits in cryptocurrency. The underlying currency you will be using is Bitcoin.

For the purposes of this guide, we will be using USD denominated futures that are settled in Tether (USDT). When you have funds in your account, you can start trading. The overall interface looks like this:

Binance Futures

Understanding Futures Leverage

Leverage allows you to take "x" times the position on your assets, so if you choose 5x leverage, you can create a $20,000 position on $4,000 of collateral. If the market goes in your favor, you end up with 5x your earnings.

However, if the market is not in your favor, you can lose the same proportions. When using leverage, keep in mind that the amount of leverage you use can substantially increase your income as well as your losses. Binance Futures allows you to trade with up to 125x leverage.

Binance Futures

Now that we've gone through the initial setup for futures trading, let's dive deeper into the procedures required to actually trade futures on Binance.

Trading Ethereum Futures on Binance Futures:

Once you have transferred some funds from your spot account to your futures account, you can continue trading on the futures trading screen. Entering the desired price in the "Price" and "Size" tabs as shown below will allow us to buy futures at that price.

Binance Futures

The next step is to create a sell/short order or buy contract. For example, if you decide to short Ethereum, you can place a buy order at a price that is lower than the current price. In this situation, you will be able to sell it for, say, $2,000 and then buy Ethereum again for $1,500. (when the market goes down). This will allow you to earn $500.

Binance Futures

Trailing Stop command

When you want to lock in your profits when the contract price rises, a trailing stop is a useful solution. It helps you make a profit as the price rises at a certain "callback rate". However, it does not work in the opposite direction, so if the price starts to fall, your position is effectively closed at the market price.

Binance Futures

After opening your position, all these orders work as expected. The “TP/SL” (Take profit/Stop loss) option is available right here if you want to specify an upper and lower limit at which you take profits and stop losing.

Binance Futures

Let's say we bought 1 ETH for $2000. Our position will be sold and we will make a profit of $500 if we set the "Take Profit" limit to $2500. On the other hand, since we set the "Stop Loss" limit at $1500, if the price falls below $2000, say, at $1500, then our trade will suffer a loss of $500. Futures trading requires a high level of technical understanding, thorough market awareness as well as active market participation.

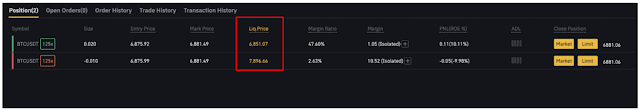

Forced liquidation of Binance

Liquidation is the process of offloading cryptocurrency holdings for cash to reduce losses in the event of a market crash. The forced closing of a trader's position due to a partial or complete loss of the trader's initial margin is the most common application of the term "liquidation" in the cryptocurrency market. This occurs when traders lack the capital to hold an open position.

Binance Futures

Binance Exchange

The key message is that while more leverage can potentially lead to higher profits when the trade is successful, it only takes a slight downward movement in price to liquidate. For example, a 2% drop in price is enough for a 50x leveraged trading position to start the liquidation process.

0 Comments